Pre-Prime: HBO’s Off-Channel Revenue Legacy

It makes sense we would focus on the future. HBO’s streaming deal with Amazon Prime is clearly an effort to prepare for a streaming future, enabling HBO to have both a branding presence and a revenue stream tied to an increasing amount of viewers who stream their television instead of subscribing to cable or satellite services.

It makes sense we would focus on the future. HBO’s streaming deal with Amazon Prime is clearly an effort to prepare for a streaming future, enabling HBO to have both a branding presence and a revenue stream tied to an increasing amount of viewers who stream their television instead of subscribing to cable or satellite services.

There is plenty to talk about regarding that future. Will audiences who currently subscribe to HBO be more likely to cut the cord if they could access (only select) HBO programming three years later than if they subscribed to the service? Probably not. Will existing—particularly young—cordcutters become more likely to subscribe to HBO in the future when they’re in a financial position to do so if they’re more engaged with the channel’s library? Maybe. Will HBO ever make current flagship series Game of Thrones available on Amazon Prime while it’s still airing? Doubtful.

As interesting as those questions are, I want to consider how this deal reflects the history of HBO embracing new forms of distribution in the interest of connecting with audiences unable to afford or unwilling to pay for HBO subscriptions. Although often marginalized within these conversations in the contemporary moment, both syndication and home video were once similar points of outreach for HBO and other cable channels, and they are implicitly a significant factor in HBO’s current streaming strategy even if they go unnamed in official press releases.

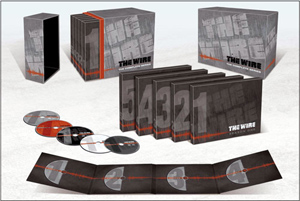

HBO’s decision may be primarily focused on the streaming future, but it is predicated on the home video past. In an age before streaming, DVD sets were how you caught up with a show like The Wire, and even in the wake of HBO GO it was how you caught up with The Wire without having to subscribe to cable (at least if you weren’t borrowing someone else’s HBO GO password). With premium price tags and elaborate packaging, sets for series like Six Feet Under, The Sopranos, Rome, and Deadwood were a key space where HBO could package their prestige programming for a different audience.

If that DVD market were still healthy, one imagines HBO might have been more resistant to signing streaming deals that will further limit the appeal of those library titles: although DVD/Blu-Rays of current series will retain value (both for collectors and those unwilling to wait three years for them to arrive to Amazon), I would be interested to see if the company’s print runs on legacy DVD sets begin to shrink even further. Without knowing the financial details behind the Amazon deal, it seems safe to say that HBO ran the numbers of how this might affect their DVD business, and that their decision to embrace off-channel streaming is a tacit acknowledgement that the TV on DVD bubble burst some time ago.

If the Amazon deal signals HBO moving past its legacy DVD business, however, it simultaneously signals their inability to completely move past its limited foray into syndication. Notably absent from the deal are three comedy series that were sold into both basic cable and broadcast syndication: Entourage, Curb Your Enthusiasm, and Sex and the City. Although the first two were quickly pulled from broadcast syndication after heavy editing gutted their appeal, edited episodes of Sex and the City had a stronger run on broadcast, a banner run on TBS, and currently air on E!, while both Curb Your Enthusiasm and Entourage retain cable syndication deals on TV Land and Comedy Central, respectively.

If the Amazon deal signals HBO moving past its legacy DVD business, however, it simultaneously signals their inability to completely move past its limited foray into syndication. Notably absent from the deal are three comedy series that were sold into both basic cable and broadcast syndication: Entourage, Curb Your Enthusiasm, and Sex and the City. Although the first two were quickly pulled from broadcast syndication after heavy editing gutted their appeal, edited episodes of Sex and the City had a stronger run on broadcast, a banner run on TBS, and currently air on E!, while both Curb Your Enthusiasm and Entourage retain cable syndication deals on TV Land and Comedy Central, respectively.

Although all three are offered as part of HBO GO, they are absent from the Amazon announcement, implying that the nature of HBO’s contracts prohibits their sale of that content to streaming services while existing syndication deals are in place. In the case of Sex and the City, which entered into syndication before streaming was even a thing that existed, its most recent deals have been explicit about the role of streaming: reporting about its current deal with E! suggests online rights were included in the deal. While streaming deals and syndication deals may function somewhat differently, more recent syndication deals would appear to have offered streaming as part of the package, which seemingly makes it impossible for HBO to re-license that content to a third party in any capacity while existing deals are in place.

Premium cable’s relationship with streaming has always been complicated: Showtime and Starz each ended content deals with Netflix in order to build greater value into their own subscription streaming services, with Showtime only recently returning to Netflix with Dexter following the series’ conclusion. None have jumped in head first because they run on business models that require careful cultivation of value centered on subscriptions but relying on these sources of ancillary revenue (and exposure). The delay in HBO’s case is tied to both their efforts to translate their library into a subscription incentive through HBO GO—which were clearly not so successful that HBO could refuse Amazon’s likely rich financial offer—and the fact that they remain linked to previous equivalents to streaming’s ability to extend their content beyond the premium cable paywall.

HBO’s deal with Amazon signals their willingness to move past one of those models, and their inability to move past another, at least until the current syndication deals run out. When that happens, though, we will gain greater insight into how these two forms of value compare. If cable channels remain willing to pay a premium for edited versions of Sex and the City, are Amazon’s terms lucrative enough to compete? While our focus on the future makes the choice of streaming seem like common sense, HBO’s focus on the bottom line could make a different decision with streaming than it did with its legacy DVD business when the time comes.

[…] a concession to the shifting media market, and a transference of their brand to a new domain. As Myles McNutt remarks, HBO has always eventually, and effectively utilized new forms of distribution to grow their […]