Content the King Is Dead! Long Live Content the King!

Thoughts on the 2014 Time Warner Thought Leadership Faculty Seminar

Thoughts on the 2014 Time Warner Thought Leadership Faculty Seminar

The media industry mantra “Content is king” once reflected the legacy industry’s power to dictate terms of media consumption through oligopolistic distribution and pricing. But technological change has undermined content control, and so at last many in the media industry are acknowledging a new ruler: the audience. Fortunately, the audience has an insatiable demand for content. Hurrah: long live content the king!

I saw this shift in industry discourse first hand at the 2012 and 2014 Time Warner’s Thought Leadership Faculty Seminars. As I previously reported, presenters in the July 2012 seminar insisted that TW was committed to “bolstering the ecosystem,” that is, the old business models. I saw presentations on the evils of “piracy” and the importance of physical media (DVDs), and I heard confident predictions that time-shifting millennials will enjoy linear viewing and commercial interruptions once they get a bit older.

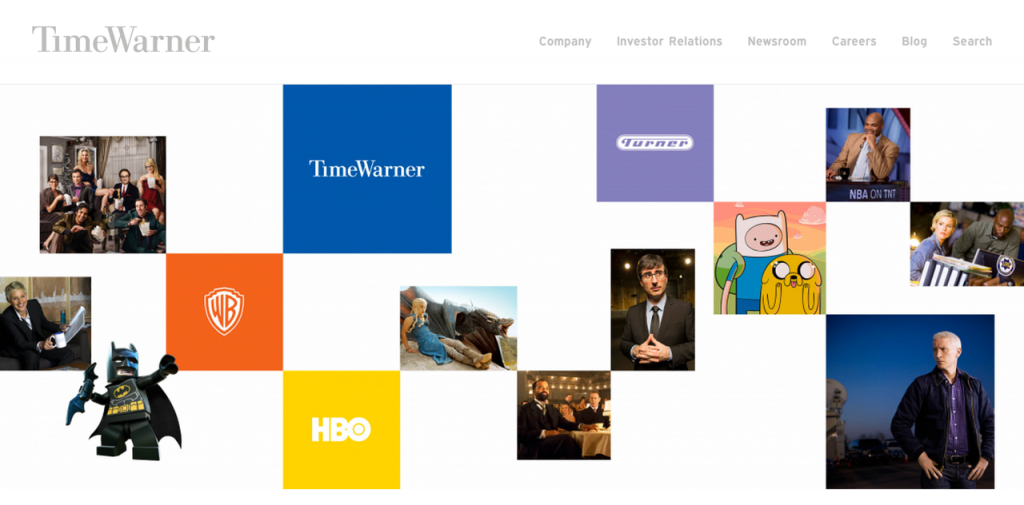

TW executives toed a different line in July 2014. Opening the seminar, the Warner Bros. Senior Advisor of Media Research explained that TW executives are kept awake at night worrying about how “to protect our assets” from the “volatility of the media ecosystem.” Rather than sustain the “status quo” (translation: fight a rear guard action against change), TW must adapt to the “disruptive forces that challenge our business models.” Within the past decade TW has shrunk from a behemoth conglomerate to only three companies: HBO, Turner, and Warner Bros. Reducing its dependence on advertising revenues by spinning off Time Magazines and AOL, TW is now a “pure content play,” which will, executives claim, continue to thrive however distribution platforms evolve. HBO, as one of these executives baldly announced, plans to “feed the addiction” for its content. HBO’s recent deal with Amazon may indicate it is studying Amazon’s strategies for building consumer dependency.

When asked about the threat of piracy, the HBO executive neatly “pivoted” to piracy’s value as a form of market research: “Our learnings are that hits drive pirating behavior; hits attract pirates; and if we can convert pirates to paying customers, maybe one in ten, that will add up to real dollars.” Another TW executive described a new “consumer friendly” approach to handling unauthorized access to content. “We want to give consumers easier access,” she explained, because “that’s where innovation is going on.” So TW is “piloting in the sand, not in concrete, because the world is changing.” TW wants to be flexible enough to follow consumers wherever they go (although the metaphor of sand seems an unfortunate one).

Though they conceded that young viewers timeshift, TW executives still insisted on the primacy of scheduled linear viewing, pointing to the “water cooler” value of Game of Thrones episodes. The HBO executive noted that social media chatter spikes when an episode is first released, then trails off. To “manage this conversation” and “keep subscribers engaged over time,” HBO simply has “too much investment in shows to release all episodes at once,” Netflix-style. HBO’s subscription strategy depends on an artificial scarcity of episodes (“We want to retain subscribers”), possibly because HBO is still dependent on MSOs to deliver their customers. Recently, however, TW CEO Jeff Bewkes has openly noted that HBO is trying to become more like Netflix, not the other way around, indicating a possible shift away from the strategy of content withholding.

A CW executive explained the changing economics of television advertising. In 2012, TW executives insisted that online (“digital”) episodes should have the same ad load as linear TV. Advertisers, however, were reluctant to pay for online viewership without the demographic data Nielsen supplies for linear viewership. In 2014, knowing the majority of its young audience timeshifted on digital platforms, the CW partnered Nielsen and Doubleclick data to prove that at least half of their digital viewers were the targeted 18-34 year olds. By offering to charge advertisers only for the 18-34 year olds (in other words, providing a 50% discount), the CW was able to sell more ads, doubling the ad load per episode, and thus to come out even. The CW also offered advertisers more buying flexibility. Most networks force advertisers who want to buy time on a top-rated program to buy time also on a lower-rated one; the CW allowed advertisers to buy only on the programs they wanted. The CW executive noted, however, that viewing and click-through metrics for digital commercials seemed to have much more to do with the quality of the commercial “creative” (the ad idea and execution) than with the quality of the program interrupted by that commercial. All these changes favor the advertiser, not the audience: eschewing policies such as YouTube’s True View, in which audiences may skip a commercial, the CW, like most of the rest of the television industry, continues to search for the holy grail: a technology that makes everybody watch the commercials.

Warner Bros. Home Entertainment, once the revenue powerhouse driving DVD sales, is now focusing on how to take TW film and TV content and “monetize it downstream.” Noting that physical media is a dying market, a Home Entertainment executive explained the new strategy of “electronic sell through.” In 2012, WB promoted Ultraviolet, a difficult-to-use digital service; in 2014, WB is simplifying consumer sharing experiences (although the “legal team is nervous”) and experimenting with social media, online communities of fans (WB A-list), and “long tail” content (WB Archive Instant has “rabid fans”).

Although the Time Warner Thought Leadership Faculty Seminar is designed by its media research executives, and so reflects only one company’s views, I recommend that scholars interested in learning more about the changing media industries attend these free events. Unlike trade press articles or industry conferences, they allow us to ask questions directly of industry executives, who likewise may benefit from hearing our perspectives. The 2014 seminar ended with TW executives making a plea for collaborative research with academics: as one executive put it, professors can research “longer term future ideas” that TW can’t get to because they “have to deal with today.” Whether or not we choose to collaborate with TW, this two-day seminar can teach us a lot about how such a legacy media conglomerate is hoping to transform disruption into “opportunity.”